Summary:

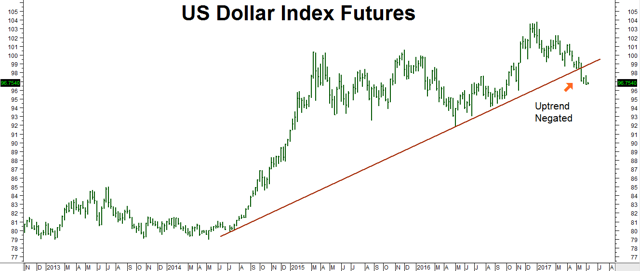

- Last Friday’s close in the US Dollar Index was the third consecutive weekly close below its 3-year old uptrend line.

- With the Fed on course to raise rates again later this month, these advantages could grow.

- While the dollar has not entered bear market territory yet, recent weakness could signal a change in the fundamental picture.

Last Friday's close in the US Dollar Index was the third consecutive weekly close below its 3-year old uptrend line. This puts a continued dollar rally in doubt. What fascinates us most about the chart below is that, with the exception of a brief run to new highs in the first week of 2017, the greenback has essentially been moving sideways for the past two years despite its huge interest rate advantages over Europe and Japan.

With the Fed on course to raise rates again later this month, these advantages could grow. But the dollar doesn't seem to care. Markets that move in a direction opposite those suggested by underlying economic fundamentals are either mispriced or acting as a precursor to a change in those fundamentals.

While the dollar has not entered bear market territory yet, recent weakness could signal a change in the fundamental picture. With a fully-priced stock market and the isolationist wing of the White House in ascendance, the US is in danger of losing ground to Europe and emerging markets in the fight for global capital. This could reduce the bullish pull of its high relative interest rates - and perhaps negate them altogether.

A continuation of the current bearish pattern, marked by a series of lower highs and lower lows, since the beginning of the year is threatening to turn this tired dollar bull into a bear. As we outlined in our first "Big Move Trade Alert" of the New Year, it could have big bullish implications for a number of key market sectors - including agricultural commodities, energy and precious metals. The slipping dollar is a big reason behind our recent long-term bullish positions in silver, cocoa and coffee.

Comments

Post a Comment